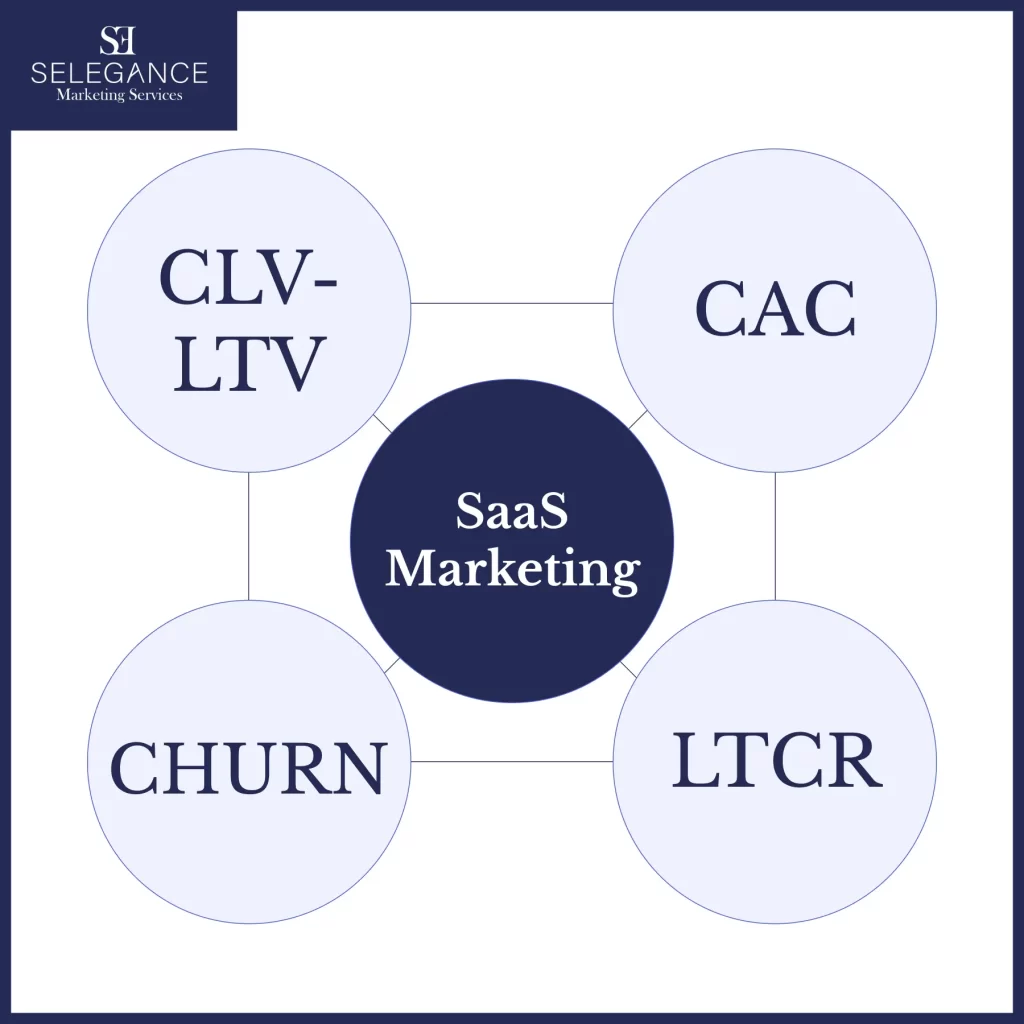

I often meet B2B SaaS business owners in Australia and New Zealand looking to acquire more clients online. Whenever I meet them and I’m asked where to begin, one of my first questions is: do you know your numbers? I know, I know, when talking about numbers, not everyone, business owners included, gets excited. But if you know me, I’m all for simplicity. I like to focus on things that move the needle. And that’s exactly what I tell SaaS business owners to do, the important marketing metrics that will make a difference and help you make solid decisions. What are they? Here are the marketing metrics B2B SaaS businesses must track to make solid decisions.

What Is Customer Acquisition Cost (CAC) And To Calculate It (CAC)

Customer Acquisition Cost (CAC) is simple to understand and calculate, it’s how much you spend to acquire one new customer within a specific period.

Formula

CAC = (Total Sales + Marketing Costs) ÷ (Number of New Customers Acquired)Practical example: If last year you spent $200,000 on marketing and sales to promote your software and you acquired 20 new customers, your CAC is $10,000 ($200,000 ÷ 20 customers).

To calculate CAC, add up all your sales and marketing expenses for that period. Include all the costs, agencies, salaries, software, ad spend, etc. Then divide that total by the number of new customers acquired during the same timeframe. I prefer using a one-year period because it gives a clearer picture, especially in B2B, where sales cycles are longer than in B2C.

How CAC Helps You Make Marketing Decisions?

You probably understand by now that CAC tells you how much your marketing is “costing” you. If your CAC increases and so does the number of paying clients, that’s still a positive sign. However, if your CAC increases while your results stay flat, it’s time to look at what’s not working in your marketing.

Tip: If you are running ads, you may be tempted to focus on acquiring clients for the least amount of money possible. That is dead wrong! While you should always try to optimise your CPA, always focus on your ROI rather than your cost.

Customer Lifetime Value (CLV or LTV): What It Is, How To Calculate It And Why It’s Crucial For Your B2B SaaS Business

Grab a pen and paper, as this is one of the most important numbers in your business (alongside your CAC). Customer Lifetime Value (CLV or LTV) tells you how much revenue, on average, you earn from a customer over the entire duration of your relationship with them.

Important note on sample clients

When calculating LTV, don’t just use all clients ever. Instead, use a representative sample of customers who reflect your current pricing, product, and business model.

- Exclude extreme outliers (very large or very short-lived clients).

- If your customers are very different (e.g., SMB vs. enterprise), calculate separate LTVs by segment.

- Ideally, use recent customers (e.g., last 12–24 months) to capture current retention patterns.

Formula

CLV = (Average Purchase Value) × (Average Purchase Frequency) × (Average Customer Lifespan)

Practical example: Suppose your software subscription is $1,000 per month, plus a one-off setup fee of $5,000, and the average customer stays for 3 years or 36 months. If you regularly sell add-ons or extra implementations, tweak both monthly revenue and average purchase frequency. For simplicity, let’s pretend that this B2B SaaS charges $1,000 per month for their “as-a-service” model.

Calculation:

- Monthly revenue × Average Purchase Frequency × Months = $1,000 × 1 × 36 = $36,000

- Add setup cost = $36,000 + $5,000 = $41,000

So, this hypothetical B2B SaaS business owner is acquiring a client for $10,000 and earning $41,000 from each of them. In this case, the CAC-to-LTV ratio is about 1:4.

Tip: What Is A Healthy Ratio CAC: LTV Ratio

For B2B SaaS businesses, the minimum to aim for is 1:3. Anything below that means you may be:

- Paying too much to acquire clients, hence your marketing strategy needs to be refined.

- Not generating enough upsell revenue

- Losing clients too early (i.e., you have a high churn rate, which we’ll discuss in the next chapter).

Why LTV Matters in Marketing And How to Use It To Make Solid Marketing Decisions

If you’re running a SaaS business, tracking your LTV (Lifetime Value) is one of the smartest moves you can make. It’s a magic number that gives you a clear picture of how much each customer is truly worth and helps you make marketing decisions. Here’s how to use it:

Set your growth ceiling. Calculate your average LTV and use it to determine how much you can safely spend to acquire a customer.

Example, if your average customer generates $41,000 over their lifetime, aim to spend up to $10,000 to acquire them.

Evaluate your channels. Track LTV by marketing source to see which channels deliver your most valuable customers. Double down on channels that bring long-term, high-value users, and reconsider channels that only bring low-value leads.

Target and retain high-value customers. Identify your top LTV segments and use the insights to build campaigns that extend the customer journey, like nurturing, cross-sells, and loyalty offers.

Churn Rate Explained: How to Calculate It and Why It’s Critical for Your B2B SaaS Growth

Churn rate is another crucial metric for any B2B SaaS business. It tells you how many customers stop using your software over a given period. A high churn rate can quietly drain your revenue and growth. To calculate your churn rate, divide the number of customers lost during a period by the total number of customers at the start.

Formula

Churn Rate = (Number of Customers Lost During Period) ÷ (Total Customers at Start of Period)Practical example: Suppose you had 50 retainer clients using your software at the start of this month, and at the end of the month you had 45. Your churn rate would be (5 ÷ 50) × 100 = 10%.

How Often Should You Calculate Your Churn Rate And How to Use To Make Better Decisions

Tracking churn helps you spot problems in your offering. For example, a high churn rate may be symptomatic of poor onboarding or customer support, two crucial elements that make your clients loyal for life and therefore increase your LTV and cash flow. Lowering churn means more predictable revenue, again important data within your business and growth plan.

Lead-to-Customer Rate: The KPI That Shows If Your Marketing Funnel Is Working

As you may know, getting leads isn’t the problem. Getting good leads is the real problem. The Lead-to-Customer Rate (LTCR) shows the percentage of your leads that turn into paying customers. It helps you understand how effective your sales and marketing strategies and processes are at turning interest into revenue.

Formula

Lead-to-Customer Rate = (Number of New Customers ÷ Number of Leads) × 100

Practical example: Suppose you generated 20 leads in a month and 3 of those converted into paying clients. Your lead-to-customer rate would be 15%, Lead-to-Customer Rate = (3 ÷ 20) × 100 = 15%.

How to Use Lead-to-Customer Rate To Make Smarter Marketing Decisions

Tracking LTCR lets you identify bottlenecks in your marketing and sales funnel. If you acquire many leads that don’t convert into clients, don’t fire your sales team member just yet, look into these marketing elements first,

- Does your offer solve a painful, urgent problem?

- Are you targeting the right personas?

- Is your positioning clear and strong?

Lead-to-Customer Rate and Sales

Too often, we marketers shy away from the “sales” topic. We feel that our job ends once we’ve provided leads to the sales department. Personally, I think the industry has got it all wrong. Marketers and sales teams should be working side by side, not in silos. So engage your marketing and sales team and together evaluate the sales process too. Focus on these elements:

- Is the sales script or conversation of the sales team strong enough? Are you building trust and handling objections promptly?

- What’s your follow-up system? (Most sales come from follow-up.)

- What’s the timeframe between the lead opting in and the sales team calling the person? How is your CRM set up? The faster you reach out to a lead, the higher the conversion.

A Final Word

That is my list of marketing metrics B2B SaaS businesses must track to make solid decisions. There are obviously many other metrics you should analyse to get the full picture of your marketing machine but these are, in my opinion, the top-level numbers that will help you sound the alarm and dig deeper into what’s happening within your marketing infrastructure. I hope it helps you make smarter marketing decisions!